Christopher Aaron – How High Could This Next Leg Of The Bull Market In Gold Go?

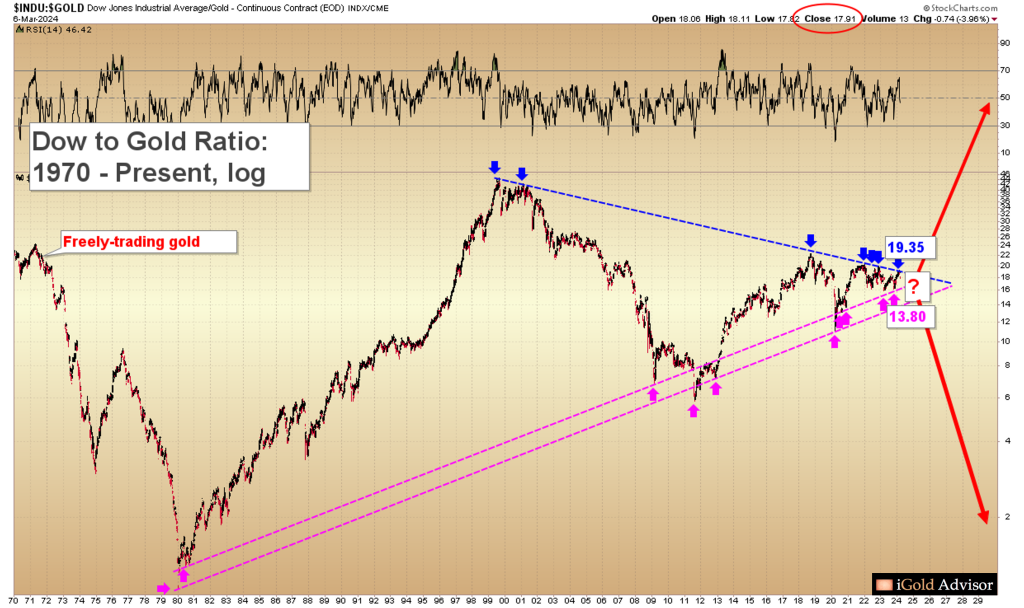

Christopher Aaron, Founder of iGold Advisor and Senior Editor at the Gold Eagle website, joins us to review the technical breakout in gold, how high this next leg of the bull market could extend to out of the rectangular consolidation, updates on how the Dow:Gold ratio chart is advancing, and thoughts on how the gold and silver mining stocks may respond initially and then later in the move. This is a very wide-ranging and nuanced discussion, where multiple paths forward in the precious metals and general US equity markets are discussed, along with the path forward that Christopher sees as most probable. (We share a number of charts visible below to help listeners follow along with the discussion).

.

Click here to visit the iGold Advisor website to keep up with Christopher’s market commentary.

.

We will have a pullback as you suggest but the stocks will pullback even more, take Santacruz, investors are dumping this stock despite this run up. No wonder 95% of investors lose money, most people should buy the physical like OOTB, then they wouldn’t lose their money. But people love gambling, and the money always stays with the house, but you can’t tell the rabble that they prefer to take a bath and then blame it on someone or something else that is always beyond their control, although they made the choice to buy.

It is no wonder that human psychology dominates everything we do in life. Just figure the flavor of the day like buying pants with a rip in the knees and do the opposite. LOL! DT

Thanks DT….. for the mention…. 🙂

I don’t follow Santacruz Silver but it seems something is holding it back. Maybe it’s the low cash position and/or recent earnings but it seems like it wants to go lower. It bounced 22% off its recent low while Impact Silver bounced 42% and Endeavor and Coeur bounced 38% and 36% respectively. Kootenay and Brixton are obviously not producers but they bounced 46-47%.

Maybe Santacruz just needs higher silver or for silver to show real strength relative to gold. We will know soon because both are coming soon.

Gold closed at an interesting level after 7 days straight up on heavy volume…

https://stockcharts.com/h-sc/ui?s=$GOLD&p=D&yr=1&mn=5&dy=0&id=p00555266946&a=1382601865&listNum=3

Thanks for the chart Matthew. Looks like fast steep correction is in order.

https://tinyurl.com/3e2m75pr

NatGas Week: Sour Turn

Deeper Is Possible

Thanks for having Christopher on. I really enjoy his analysis.

After 6 straight days higher along with two gaps and 4 straight above the Bollinger Bands I’d be surprised if today doesn’t turn red. A pause/pullback is needed.

GDXJ

https://stockcharts.com/h-sc/ui?s=GDXJ&p=D&yr=1&mn=0&dy=0&id=p36732611146